The other day I was asked what one single thing could do the most to save our economy. What one idea or tool might help us create a more just society? My answer was "shame."

Shame isn't always a wasted or negative emotion. On the contrary, it can perform an important and socially useful function. Shame enforces our moral values even when legal and political institutions are too broken or corrupt to do so. Our society must learn to develop a "moral economics," and morality is often enforced through shame.

We live in a society where it's no longer considered shameful to oppose spending $6 billion to save nearly 8 million lives, even though that's less than $800 apiece. This kind of cynicism is so accepted, in fact, that even the more liberal political party doesn't dare suggest it. We live in a society where it's not shameful to let crooked bankers go unpunished while asking everyone else to pay the cost of their illegal enrichment. Nowadays even the lawbreakers aren't ashamed of themselves!

Incredible.

Perhaps no single change to our culture could do more to improve our lives than the rediscovery of the shame we used to attach to vile, greedy, selfish, and corrupt behavior. Consider how far we've fallen:

Not long ago a person would have been ashamed to appear in public if they had shattered the global economy by cheating millions of innocent people, accepted the outstretched hands of the same people they'd cheated by accepting an unconditional bailout, and then cheated them again.

Not long ago a politician who accepted the corrupting dollars of known criminal bankers immediately paid a steep price. (See the Keating Five, for example.)

Not long ago political figures and pundits were ashamed to openly advocate the deaths of millions of people just to provide tax advantages for the wealthy or ensure more favorable market conditions for predatory corporations.

In 2012, it's time for shame to make a comeback.

Where would it be useful? Here are just four examples out of thousands to choose from:

1. We should be ashamed that we don't give more to fight global AIDS.

A new medical study showed that developed nations could save 7.9 million lives in the next eight years by increasing AIDS funding for developing countries by $6 billion. That comes out to about $760 for each human being whose life would be spared. As an added benefit, an estimated 2.5 million people would never be infected with AIDS at all.

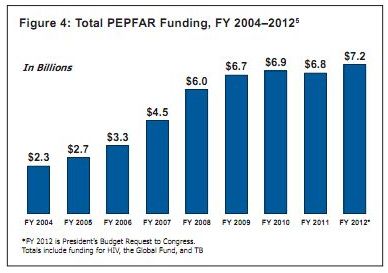

George W. Bush began the anti-AIDS program known as PEPFAR in 2003, and funding grew steadily every year until President Obama took office. It then flatlined in the first year and dropped in the second year, before increasing slightly in the third Obama budget:

But the Republican Party opposes anything like that, and President Obama hasn't asked for more.

2. Leaders of serial corporate criminal banks should be ashamed of themselves.

Jamie Dimon, CEO of JPMorgan Chase, makes it a habit to publicly express his resentment at the very mild and genteel criticisms that lawbreaking bankers must endure in our society. He does so with a combination of disingenousness and genuine self-deception that is a marvel to watch. In his latest outburst, Dimon complained about Occupy Wall Street by saying, "Acting like everyone who's been successful is bad and because you're rich, you're bad, I don't understand it. Sometimes there's a bad apple, yet we denigrate the whole."

Maybe those "bad apples" would provoke a different reaction if executives like Dimon weren't personally supervising such a large barrelful of 'em. Shortly after Dimon expressed his outrage, his bank and a number of its employees went on trial in Italy for allegedly deceiving a municipality into deliberately and deceptively purchasing bad investments. And while this Business Week article carefully points out that these alleged crimes took place before Dimon became CEO in 2006, he was already president and COO at the time of the worst allegations.

As president and COO, Dimon also presided over an institution that paid hundreds of millions of dollars after it bribed municipal officials in Alabama and misled investors in a fund called Magnetar. Under Jamie Dimon's leadership, JPMorgan Chase (or rather, its investors and insurers) paid a fine for breaking the law while promising not to do it again -- and then promptly did, at least three more times.

Similarly, GE Capital keeps breaking the law under CEO Jeffrey Immelt. In its latest settlement, a division of GE paid (or rather, its investors and insurers) paid $25 million after being charged with what the SEC described as "fraud for participating in a wide-ranging scheme involving the reinvestment of proceeds from the sale of municipal securities."

This is merely the latest in a GE crime spree that includes misleading investors, bribing Iraqi officials in the "oil for food" scandal, and what the SEC described as "fraud, deceit, or deliberate or reckless disregard of regulatory requirements [that] resulted in substantial loss, or significant risk of substantial loss, to other persons."

And yet Immelt, like Dimon, walks in polite society. He even leads President Obama's recently renamed "Jobs Commission."

Nobody is saying "because you're rich, you're bad." Nobody's calling Warren Buffett bad, for example. They're not even saying that about megamillionaire Jimmy Buffett -- and after the 6,000th hearing of "Margaritaville," that's pretty damned generous if you ask me.

But here's why words like "bad" get attached to executives like Dimon and Immelt: because they or their subordinates keep breaking the law, and either they don't care about it or they aren't competent enough as managers to stop it. Their arrogance and pronounced lack of remorse suggests it's the former rather than the latter. But either way, they're in no position to lecture others, especially since the lawbreaking keeps fattening their personal bank accounts.

They should be ashamed.

3. Officials and bankers should be ashamed that "too-big-to-fail" banks still exist.

As Simon Johnson notes, "Big banks represent the ultimate in concentrated economic power in today's economies. They are able to resist all meaningful reform that could really change their compensation schemes. Their executives want to get all the upside while facing none of the true downside. But capitalism without the prospect of failure is not any kind of market economy. We are running a large-scale, nontransparent, and dangerous government subsidy scheme for the benefit primarily of a very few extremely wealthy people."

The top U.S. banks now control more of the economy than they did before the Great Recession. The Fed is secretly bailing out Europe's too-big-to-fail banks as this is being written. And nobody's doing anything to change that.

They should be ashamed.

4. It's shameful to preach welfare for bankers and austerity for everyone else.

Meanwhile, in the great capitals of Europe and North America, the talk is of austerity economics. That means drastic cutbacks in government services that the public has paid for, like Social Security, that form the backbone of a prosperous, fair, and humane society. Leaders are calling these cuts "unavoidable" even as economists warn that they're already creating a new European recession.

It is, as Paul Krugman observes, something that will appear remarkable to future historians (if any history departments survive the austerity cuts to preserve the profession). They're not prescribing the "hair of the dog"; they're forcing the entire dead animal down the public's throat.

Why would Europe's leaders propose a set of policies that is already demonstrably making the economy worse? In part, probably because it's the easiest way to prop up the current financial system. Comprehensive economic reform would threaten the institutions they feel sworn to protect. Conventional thinking is also a big part of the problem -- and conventional thinking makes no room for a "moral economics."

For that they should be deeply, deeply ashamed. The Hall of Shame includes Angela Merkel of Germany, Nicolas Sarkozy of France, David Cameron of Great Britain, and -- at times -- Barack Obama of the United States. And if they're not capable of shame, the society around them must express that shame for them. It's already moved Obama's rhetoric, and we need more of the same in the coming year.

For those who preach the radical dismantling of the government that made our society great -- especially the Republicans of the United States -- no amount of shame can be enough. And for someone like Mitt Romney, who knows how to read financial reports and clearly knows better, it's worth noting that the eighth circle of hell is reserved for those who knew better and yet did wicked things anyway.

Let's make 2012 the Year That Shame Returned to the Economic Debate.

0 comments :

Post a Comment